The entire month I’ve been reading about Sovkomflot IPO. It’s a Soviet-era company with a large number of cargo ships for transferring oil and liquid gas. This year is rather tough for the Russian government suffering from oil price plummeting and COVID pandemic. So, they decided to sell a part of the company.

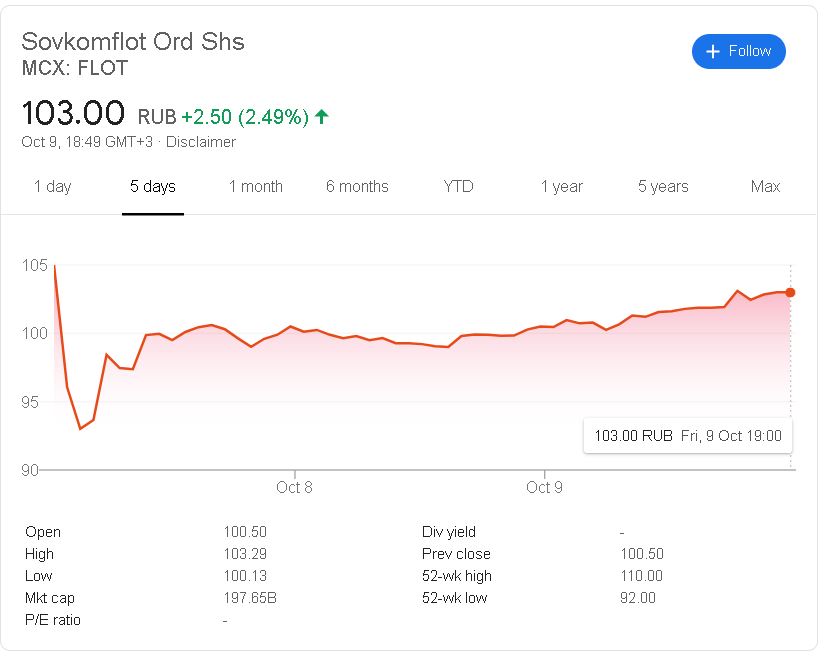

I’ve never bought shares on IPO so, I decided to participate in this event. The price range a week before IPO was in range 105…117 rubles per share. I placed a bid of 110 rubles per share and got my stocks, as all other participants for 105 rubbles. Right after the trading started, the price went down a little bit, but then bounced back almost to the initial value

On one hand, the company has ordered several years ahead and receives money in dollars. Moreover, state-owned companies should pay at least 50% of their profit in dividends.

On the other hand, we all know that government is not the best manager, and the company could be extremely ineffective. Dividends are also not guaranteed. VTB bank pays much lower to its shareholders – exceptions happen all the time.

Having said that, IPO is a good experience and this company deserves to have a try. However, a half percent of the total portfolio is the biggest weight I could afford taking into consideration all cons, I’ve said above.