This week I’ve finished the first course of specialization for individual investors on the Coursera platform. It was my second course with Prof. Berson and he is really awesome. Lots of examples and short, clear explanations. This course was more about planning and setting financial goals.

Lots of information about ways to estimate sufficient savings for retirement and about forming rainy day fund for unexpected events (very topical with all this COVID-19 events).

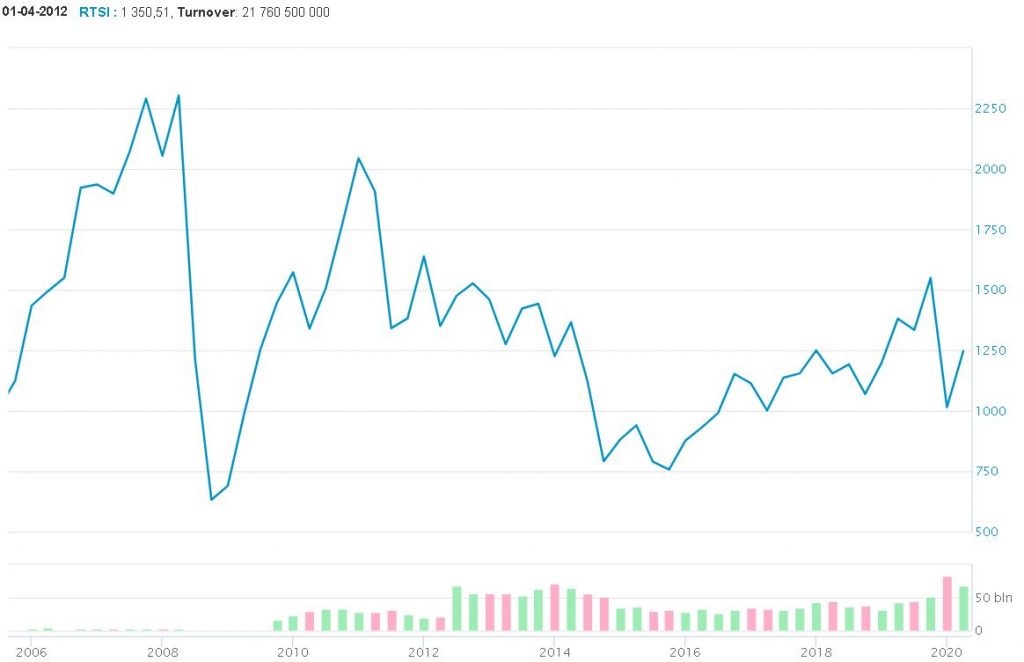

The second part was about financial tools available and different strategies for investing. In this part, I really love Russian bonds and the stock market, analysis. There is a lot of information about the US market in literature. But looks like the High School of Economy is the only one who is willing to analyze in the same way Russian market.

According to their statistic, the “bye and hold” method is the worst you can come up with for the Russian market. RTS index is going lower and lower each year and only mid-term speculations look reasonable

Before learning I had an interesting experience was with financial support. You need to buy a subscription to access the course, however, you can apply for financial aid. And Coursera granted me free access in a couple of weeks.

Unfortunately, you need to reapply your request for each course of specialization and wait for a long time. So I decided to purchase a monthly subscription and hope I could make the entire specialization in a month.

My next course is about Bonds. Prof. Stolyarov announced he will show us how to make a 100% profit on safe bonds. It looks like some dangerous trick, but we’ll see.