Personal finances

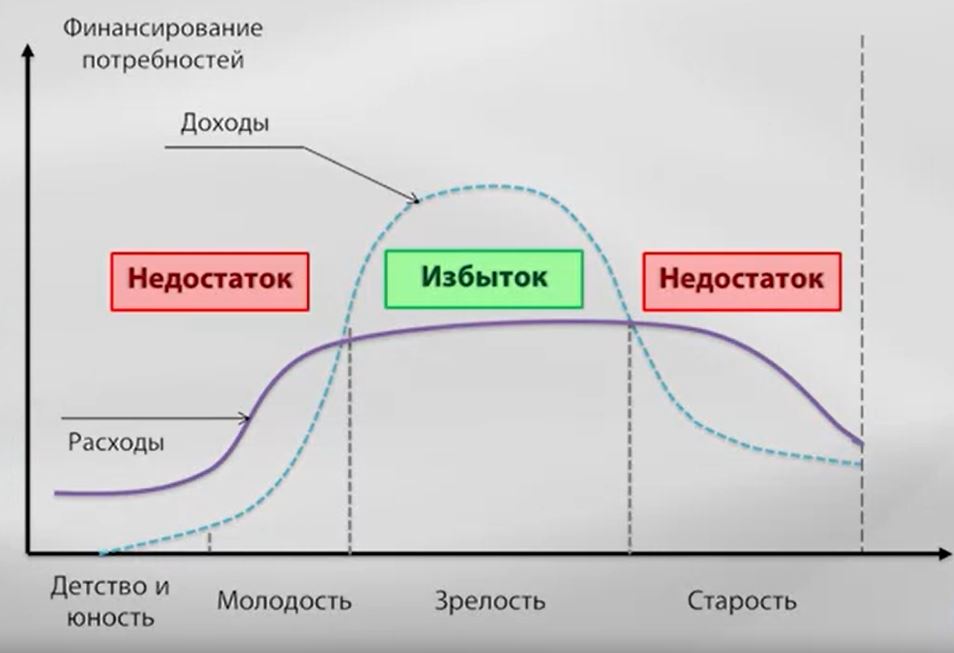

During working person has some extra money and need to manage it to have money for retirement

To achieve this target and obtain finansial independence from parents, government and children financial plan is required.

There are three types of financial targets:

- Short-term targets(less than a year): to achieve current financial goals. For these targets personal or family budget is required.

- Mid-term targets (from one to ten years): to purchase expensive things (car, appartments? cild eduation etc). For these targets savings are required. Targets should be fully defined (required sum, time before purchase and so on)

- Long-tern tergets( more than ten years: to have capital for retirement. For these targets invetments are required.

Capital distribution

Capicat can be distrubuted into three categoies:

- Current needs. This portion is going to cover every-day needs.

- Reserved money: This money is reserved for unexpected expences (job loss, severe illness, etc). Most experts think it should be about 3-6 of monthly income. To form this capital about 3-7% of monthly income should be put aside

- Invested money: This is long-term money required for retirement of long-term targets. Money are invested.

Financial tools has three characteristics:

- Profit

- Risk

- Liquidity

Below is shown priorities for different categories of capital

| Current needs | Liquidity | Low Risk |

| Reserved money | Low Risk | Liquidity |

| Invested money | Profit |

Financial tools

Bank Deposits

Pros:

- Low risk - interest rate in known, sum is insured

- Easy to use

- Flexible terms

Cons:

- Low profitability - usually less than inflation

- limitation for inssured sum

- Limited liquidity

Bonds

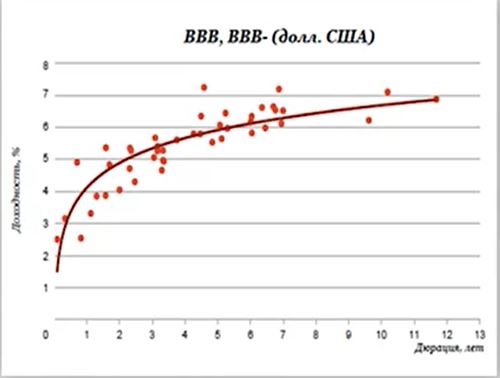

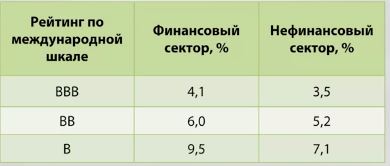

Profit from bonds depends on

- Duration - with time fiancial stability of company/state becomes less predictable and interest rate increases

- Rating of bonds - lower rating implied higher risks of default and increases profit

Shares

Structural notes

Real interest rate

Inflation could decrease profit from investments

- Nominal interest rate is equal to anual income from investment divided on invested sum.

- Real interest rate is equal to nominal interest with account of inflation. To calculate real interest rate Fisher equation is used

\[ r_r=\frac{1-r_n}{1-i}-1\]

where:

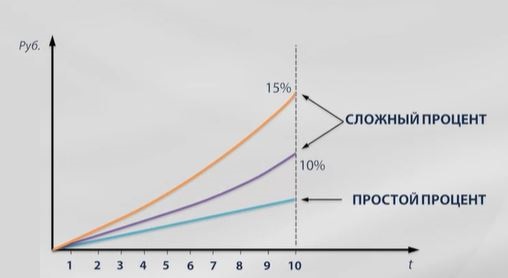

Compound interest

Compound interest (сложный процент) - is the addition of interest to the principal sum of a loan or deposit, or in other words, interest on interest.

Sum of money after several periods is calculated as:

\[FV=PV\dot(1+r)^n\] where:

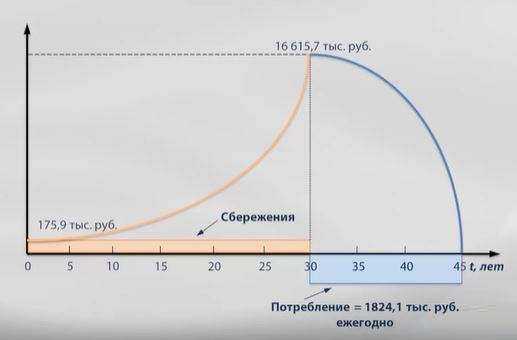

Savings for retirement

It is assumed that portion of income goes for consuming goods and portion - for savings. The consept of constant consuming implies that consuming sum is constant thoughout the life and savints should be enough to provide income afrer retirement.

Differential consuming consepts consider that on retirement person has less needs and his spendings decrease to 70% of spendings during work

Compound interest could greatly help in forming capital for retirement

The following table shows average capital distribution in retirement accounts in the USA

| Age | Shares | Bonds | Cash |

| <30 | 75% | 15% | 10% |

| 30...40 | 65% | 20% | 15% |

| 40...50 | 60% | 25% | 15% |

| >50 | 40% | 40% | 20% |